The Hidden Crisis Destroying High-Risk Businesses

Three high-risk shop owners woke up this morning to frozen merchant accounts. Their crime? Operating in an industry traditional processors no longer want to support.

By this afternoon, they’ll lose thousands in daily revenue. By next week, customers will have moved to competitors. By next month, working capital constraints will force inventory decisions that damage growth trajectory.

This isn’t a compliance issue. This isn’t a quality problem. This is the systematic abandonment of an entire industry by processors who can’t—or won’t—understand your business model.

The Shutdown Cascade

When Square, Stripe, PayPal, or Shopify terminate your account, the damage extends far beyond lost transactions:

→ Immediate Revenue Loss: Every hour offline is revenue you’ll never recover

→ Reserve Lockup: 10-20% of your capital trapped in rolling reserves

→ Customer Abandonment: Buyers don’t wait for you to fix backend problems

→ Supplier Strain: Can’t pay vendors when funds are frozen

→ Reputation Damage: Word spreads fast in tight-knit markets

Why Traditional Processors Are Exiting

Banks classify these industries as “high-risk” due to:

- Federal regulatory uncertainty around certain products

- Higher-than-average chargeback rates in the category

- Compliance complexity processors don’t want to manage

- Risk-averse institutional policies prioritizing low-maintenance accounts

The result? Thousands of legitimate merchants treated as liabilities to eliminate rather than customers to serve.

The Merchants Who Survive vs. Those Who Don’t

Survivors understand three critical truths:

- Processing stability is strategic infrastructure—not a commodity utility

- Backup continuity prevents catastrophic single points of failure

- Specialized processors outperform generalists in high-risk categories

The Non-Survivors?

They wait until termination strikes. They scramble to find replacement processing. They lose weeks of revenue. They watch competitors capture market share.

Your Move

If you’re processing with a traditional platform right now, you’re operating with unacceptable vulnerability.

The question isn’t if you’ll face disruption—it’s when, and whether you’ll have backup infrastructure in place when it happens.

Don’t wait for a shutdown to find solutions. Protect your business today.

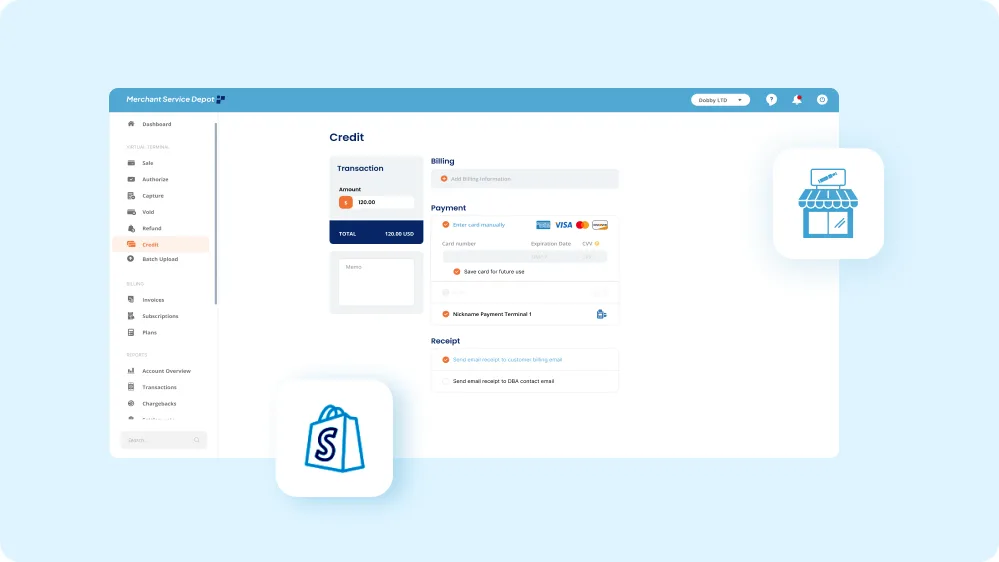

Get High-Risk Merchant Processing That Won’t Abandon You →

Merchant Service Depot specializes in keeping high-risk merchants operational with stable, compliant payment processing designed for your industry. Get approved fast and protect your revenue stream before it’s too late.

Sign in

Sign in