Expanding internationally feels exciting—until checkout friction stalls your momentum. Because payment habits, rules, and risks shift across borders, the gateway you choose can either accelerate growth or quietly cap it. Let’s connect the dots so your next market launch converts.

The global opportunity— And the catch

Shoppers don’t pay the same way everywhere. While U.S. customers lean on cards and PayPal, Chinese consumers overwhelmingly use mobile wallets like Alipay and WeChat Pay; mobile payments count hundreds of millions of active users there, so wallets win by default. Meanwhile, Dutch buyers love iDEAL—the most-used online method in the Netherlands—so if you don’t offer it, you’ll lose trust right when it matters. In Latin America, Mercado Pago’s footprint keeps expanding, including cross-rail moves like enabling Brazil’s Pix for tourists in Argentina—so travelers can pay the way they prefer.

Regulation varies just as much. Because Europe’s PSD2 requires Strong Customer Authentication (SCA), merchants often implement 3-D Secure 2 to approve card payments with less friction. And in India, UPI is the national, real-time scheme that powers everyday merchant payments—so if you’re entering India, you should plan to support it.

Why local methods win at checkout

Although global shoppers find your products through ads and SEO, they complete their orders only if the last mile feels familiar. When your gateway localizes payment options, currency, and authentication, shoppers proceed with confidence; when it doesn’t, they exit. Since roughly 70% of carts get abandoned, you can’t afford preventable checkout friction.

Three friction points you must solve

-

Currency & localization

Because buyers think in local currency, multi-currency pricing and recognizable methods reduce cognitive load and surprise fees—so completion rates improve. (Pair local currency with local rails like iDEAL, UPI, Pix, and popular wallets to boost trust.) -

Compliance & security

Since PSD2 mandates SCA in the EEA, you should support 3DS2 flows; meanwhile, card acceptance everywhere still depends on PCI DSS controls. Choose a gateway that bakes in both, so your teams don’t fight fires later. -

Reliable processing

When authorization fails at scale—because of weak routing, bank quirks, or fraud false positives—revenue leaks. Therefore you’ll want smart retries, dynamic routing, and risk tuned per market, so that legitimate transactions get through.

What to look for in a cross-border gateway

- Local methods on day one: iDEAL in NL, Klarna/BNPL across Europe, UPI in India, Pix and Mercado Pago in LATAM, plus wallets like Alipay/WeChat where relevant.

- Multi-currency & tax handling: Price, authorize, and settle in the shopper’s currency while keeping reconciliation sane.

- Built-in compliance: 3DS2 for SCA, PCI DSS alignment, and audit-proof reporting.

- Fraud controls tuned per market: Because attack patterns differ, you need adaptive risk—not one rule set.

- Developer-friendly integrations: Faster SDKs and native plugins reduce lift for Shopify/WooCommerce builds.

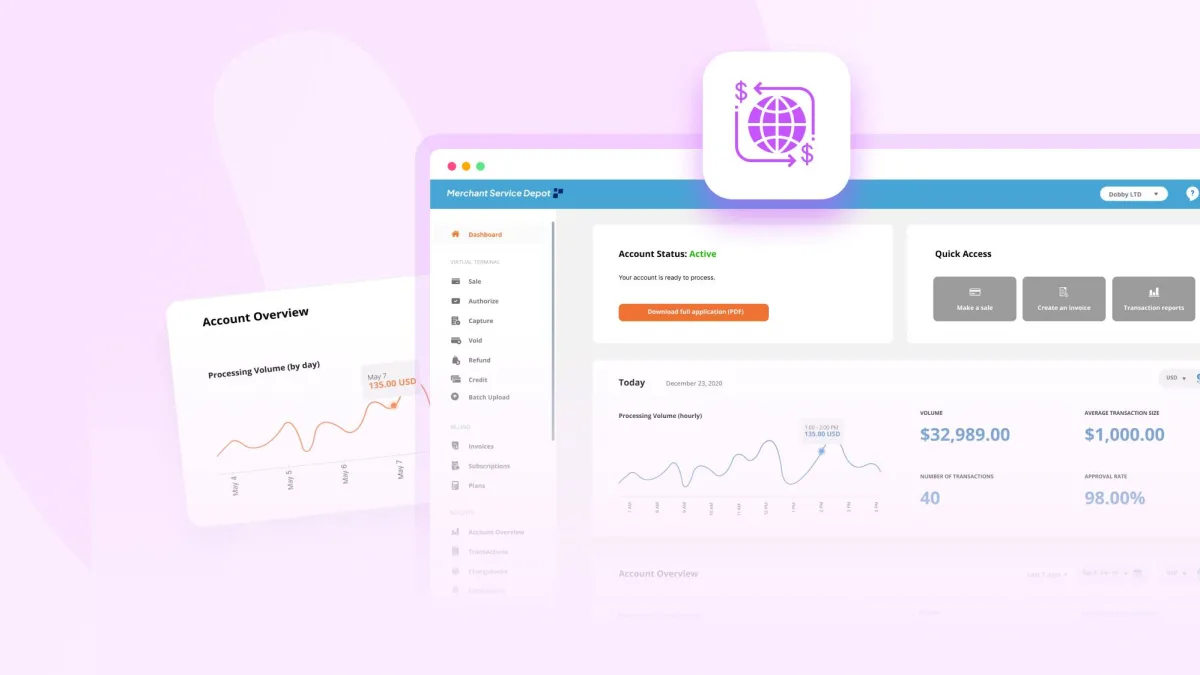

How Merchant Service Depot’s TAG helps

If you want to expand without stitching together a dozen providers, Total Acceptance Gateway (TAG) streamlines it:

- Coverage in 196 countries and 120+ currencies for true multi-market scale.

- Acceptance across ACH, QR codes, mobile wallets, and cards—so you can mirror local behavior.

- Advanced security (3D Secure 2.0 and PCI compliance) to satisfy regulators and card brands.

- Smart MID Cascading to raise approvals by routing intelligently when issuers or acquirers get picky.

- Quick integrations for Shopify and WooCommerce, so your launch moves fast.

Because TAG localizes methods, enforces compliance, and optimizes approvals, you focus on growth—not gateway firefighting.

Bottom line (and next step)

If your gateway fits each market, your expansion compounds; if it doesn’t, your funnel leaks right at the finish line. Start with your top two target countries, list the must-have local methods, confirm SCA/PCI requirements, and pilot TAG in a controlled rollout. Then measure: authorization rate, 3DS2 friction rate, refund/chargeback ratios, and checkout completion.

Ready to localize your checkout and lift approvals? Let’s map your next market and configure TAG for a test launch.

#MerchantServiceDepot #GlobalPayments #PaymentGateway #CrossBorderPayments #MultiCurrency #LocalizedPayments #3DS2 #FraudProtection #PSD2 #PCIDSS #EcommerceSolutions #FintechInnovation #ShopifyIntegration #WooCommerceIntegration #SmartMID #BusinessGrowth

Sign in

Sign in