2025/10/31 at 10:06 am

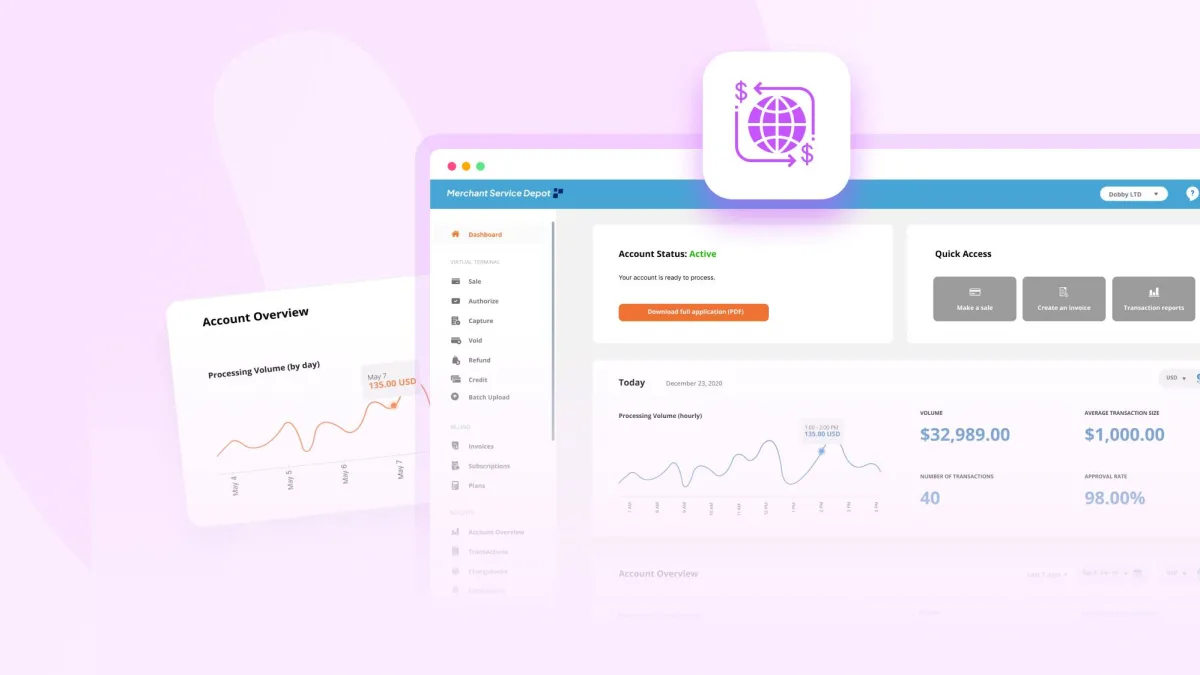

The Shift in Payments For years, merchants have focused on payment acceptance — ensuring customers could pay easily and securely. But the next frontier in financial technology (fintech) is card issuing . Commercial card issuing is transforming how businesses manage expenses, track data, and unlock new revenue streams. It’s not just about processing transactions anymore — it’s about owning …

Sign in

Sign in